Contents

Stochastic Fast plots the location of the current price in relation to the range of a certain number of prior bars (dependent upon user-input, usually 14-periods). Many unforeseeable external occurrences can place us in unforeseen circumstances in real life. Many games, such as dice tossing, have a random element to reflect this unpredictability. The legal moves are determined by rolling dice at the start of each player’s turn white, for example, has rolled a 6–5 and has four alternative moves in the backgammon scenario shown in the figure below. In SGD, since only one sample from the dataset is chosen at random for each iteration, the path taken by the algorithm to reach the minima is usually noisier than your typical Gradient Descent algorithm. But that doesn’t matter all that much because the path taken by the algorithm does not matter, as long as we reach the minima and with a significantly shorter training time.

The StochRSI reaches these levels much more frequently than RSI, resulting in an oscillator that offers more trading opportunities. The model stands on many criteria to ensure accuracy in probable outcomes. Therefore, the model must cover all points of uncertainty to showcase all possible results for drawing the correct probability distribution.

What Is The Stochastic Slow?

An important parameter of Gradient Descent is the size of the steps, determined by the learning rate hyperparameters. If the learning rate is too small, then the algorithm will have to go through many iterations to converge, which will take a long time, and if it is too high we may jump the optimal value. Alpari is a member of The Financial Commission, an international organization engaged in the resolution of disputes within the financial services industry in the Forex market. A divergence occurs when the price “diverges” from the indicator, i.e. the price makes lower lows while the indicator makes higher lows, or the price makes higher highs while the indicator makes lower highs.

Important stochastic processes such as the Wiener process, the homogeneous Poisson process , and subordinators are all Lévy processes. The Wiener process is a stochastic process with stationary and independent increments that are normally distributed based on the size of the increments. The Wiener process is named after Norbert Wiener, who proved its mathematical existence, but the process is also called the Brownian motion process or just Brownian motion due to its historical connection as a model for Brownian movement in liquids. In other words, a Bernoulli process is a sequence of iid Bernoulli random variables, where each coin flip is an example of a Bernoulli trial.

In the case of neurophysiological experiments, the validity of the ergodicity assumption, i.e., replacing ensemble averages by time averages, is often implicitly assumed. This is very convenient since it permits one to use a single stimulus presentation instead of repeated presentations of stimuli from the same ensemble. Of or relating to a process involving a randomly determined sequence of observations each of which is considered as a sample of one element from a probability distribution. The Stochastic RSI indicator, developed by Tushard Chande and Stanley Kroll, is an oscillator that uses RSI values, instead of price values, as inputs in the Stochastic formula. The indicator measures where the RSI’s current value is relative to its high/low range for the specified period. Furthermore, the model accepts possible random inputs, provides the probability distribution of possible outcomes, and is mainly used for financial planning.

Stochastic Process

One way to simplify more general, non-Markovian processes is to include suitable extra variables. This leads to a larger scheme, but, if it provides a Markov character, it can be a substantial accomplishment. A Markov process is a process where all information that is used for predictions about the outcome at some time is given by one, latest observation.

By comparing the current price to the range over time, the stochastic oscillator reflects the consistency with which the price closes near its recent high or low. A reading of 80 would indicate that the asset is on the verge of being overbought. As designed by Lane, the stochastic oscillator presents the location of the closing price of a stock in relation to the high World’s Top 10 Youngest Billionaires and low prices of the stock over a period of time, typically a 14-day period. The word stochastic originates from the Greek stochastikos, which means, “able to guess”. It is often employed to describe different scenarios where concise results can’t be obtained since there is a random variable that will cause the outcome to vary each time the phenomenon is observed.

This phrase was used, with reference to Bernoulli, by Ladislaus Bortkiewicz, who in 1917 wrote in German the word Stochastik with a sense meaning random. For the term and a specific mathematical definition, Doob cited another 1934 paper, where the term stochastischer Prozeß was used in German by Aleksandr Khinchin, though the German term had been used earlier in 1931 by Andrey Kolmogorov. In the late 1950s, George Lane developed stochastics, an indicator that measures the relationship between an issue’s closing price and its price range over a predetermined period of time. The stochastic indicator analyzes a price range over a specific time period or price candles; typical settings for the Stochastic are 5 or 14 periods/price candles.

Nonetheless, stochasticity is often ignored and instead a deterministic model is constructed and analyzed. For large metapopulations the essential behavior of the metapopulation is well captured by a deterministic model. Namely, if the deterministic model predicts that the metapopulation will persist, the stochastic model will predict that the time until metapopulation extinction is very long. The word ‘stochastic‘ means a system or process linked with a random probability.

Example of the Stochastic Oscillator

But now they are used in many areas of probability, which is one of the main reasons for studying them. Many problems in probability have been solved by finding a martingale in the problem and studying it. Martingales will converge, given some conditions on their moments, so they are often used to derive convergence results, due largely to martingale convergence theorems.

Of or pertaining to a process involving a randomly determined sequence of observations each of which is considered as a sample of one element from a probability distribution. The definition of separability for a continuous-time real-valued stochastic process can be stated in other ways. In 1910 Ernest Rutherford and Hans Geiger published experimental results on counting alpha particles. Motivated by their work, Harry Bateman studied the counting problem and derived Poisson probabilities as a solution to a family of differential equations, resulting in the independent discovery of the Poisson process. After Cardano, Jakob Bernoulli wrote Ars Conjectandi, which is considered a significant event in the history of probability theory. Bernoulli’s book was published, also posthumously, in 1713 and inspired many mathematicians to study probability.

In trading, the use of this term is meant to indicate that the current price of a security can be related to a range of possible outcomes, or relative to its price range over some time period. The „slow“ stochastic, or %D, is computed as the 3-period moving average of %K. What a explanation ,just describe in details, which is a eye opener for every new trader. And I am Indian and a newbie in stock market and places few trades in INDIAN STOCK MARKET and end up most of my trade with losing, which incurred nearly 1100$ which nearly 57000k Rupees in INDIAN Money. So please keep updating new trade set up from which we can learn to become a succesful trader. As we have seen above, when the Stochastic is above 80 it means that the trend is strong and not, that it is overbought and likely to reverse.

- However, these are not always indicative of impending reversal; very strong trends can maintain overbought or oversold conditions for an extended period.

- In contrast, the deterministic model produces only a single output from a given set of circumstances.

- Both „collection“, or „family“ are used while instead of „index set“, sometimes the terms „parameter set“ or „parameter space“ are used.

- Additionally, there is a lot of wrong knowledge being shared among traders and even widely used tools such as the Stochastic indicator is often misinterpreted by the majority of traders.

- Other types of random walks are defined so that their state spaces can be other mathematical objects, such as lattices and groups, and they are widely studied and used in a variety of disciplines.

World War II greatly interrupted the development of probability theory, causing, for example, the migration of Feller from Sweden to the United States of America and the death of Doeblin, considered now a pioneer in stochastic processes. The Poisson process is a stochastic process that has different forms and definitions. It can be defined as a counting process, which is a stochastic process that represents the random number of points or events up to some time. The number of points of the process that are located in the interval from zero to some given time is a Poisson random variable that depends on that time and some parameter. This process has the natural numbers as its state space and the non-negative numbers as its index set. This process is also called the Poisson counting process, since it can be interpreted as an example of a counting process.

Stochastic effect, or „chance effect“ is one classification of radiation effects that refers to the random, statistical nature of the damage. Non-deterministic approaches in language studies are largely inspired by the work of Ferdinand de Saussure, for example, in functionalist linguistic theory, which argues that competence is based on performance. This distinction in functional theories of grammar should be carefully distinguished from the langue and parole distinction.

4 Statistical Scatter

This system have proven very profitable in the past and it is already being used by various other financial firms. Almost certainly, a Wiener process sample path is continuous everywhere but differentiable nowhere. Donsker’s theorem or invariance principle, also known as the functional central limit theorem, is concerned with the mathematical limit of other stochastic processes, such as certain random walks rescaled.

In the context of point processes, the term „state space“ can mean the space on which the point process is defined such as the real line, which corresponds to the index set in stochastic process terminology. The term „separable“ appears twice here with two different meanings, where the first meaning is from probability and the second from topology and analysis. For a stochastic process to be separable , its index set must be a separable space , in addition to other conditions. The Wiener process or Brownian motion process has its origins in different fields including statistics, finance and physics. In 1880, Thorvald Thiele wrote a paper on the method of least squares, where he used the process to study the errors of a model in time-series analysis.

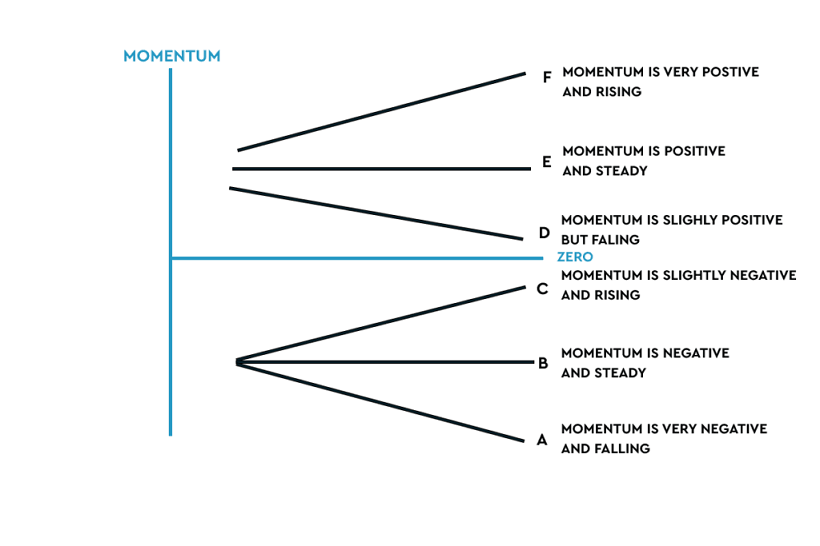

For example, a vendor might use a stochastic model as a way to model out a particular service and its uptime. In music, mathematical processes based on probability can generate stochastic elements. Simonton argues that creativity in science is a constrained stochastic behaviour such that new theories in all sciences are, at least in part, the product of a stochastic process. The K line is faster than the D line; the D line is the slower of the two. The investor needs to watch as the D line and the price of the issue begin to change and move into either the overbought or the oversold positions.

Measure theory and probability theory

However this alternative definition as a „function-valued random variable“ in general requires additional regularity assumptions to be well-defined. In this way, the stochastic oscillator can foreshadow reversals when the indicator reveals bullish or bearish divergences. This signal is the first, and arguably the most important, trading signal Lane identified.

If a Poisson process is defined with a single positive constant, then the process is called a homogeneous Poisson process. The homogeneous Poisson process is a member of important classes of stochastic processes such as Markov processes and Lévy processes. The word itself comes from a Middle French word meaning „speed, haste“, and it is probably derived from a French verb meaning „to run“ or „to gallop“. The first https://1investing.in/ written appearance of the term random process pre-dates stochastic process, which the Oxford English Dictionary also gives as a synonym, and was used in an article by Francis Edgeworth published in 1888. A computer-simulated realization of a Wiener or Brownian motion process on the surface of a sphere. The Wiener process is widely considered the most studied and central stochastic process in probability theory.

Kolmogorov was partly inspired by Louis Bachelier’s 1900 work on fluctuations in the stock market as well as Norbert Wiener’s work on Einstein’s model of Brownian movement. He introduced and studied a particular set of Markov processes known as diffusion processes, where he derived a set of differential equations describing the processes. Independent of Kolmogorov’s work, Sydney Chapman derived in a 1928 paper an equation, now called the Chapman–Kolmogorov equation, in a less mathematically rigorous way than Kolmogorov, while studying Brownian movement. The differential equations are now called the Kolmogorov equations or the Kolmogorov–Chapman equations. Other mathematicians who contributed significantly to the foundations of Markov processes include William Feller, starting in the 1930s, and then later Eugene Dynkin, starting in the 1950s. Also starting in the 1940s, connections were made between stochastic processes, particularly martingales, and the mathematical field of potential theory, with early ideas by Shizuo Kakutani and then later work by Joseph Doob.