Each of these acts contributes to a worldwide infrastructure geared toward making it increasingly difficult for criminals to launder cash and finance terrorism. They reinforce the necessity for financial institutions to establish sturdy compliance packages that embrace CDD, transaction monitoring, and the reporting of suspicious actions. Blockchain analysis and monitoring instruments allow monetary establishments and legislation enforcement to identify and investigate suspicious cryptocurrency transactions. Anti-money laundering laws cover a restricted vary of money-laundering activities and criminal exercise however the implications are far-reaching. For instance, AML rules require monetary institutions that concern credit or accept buyer deposits to observe customer conduct to make sure that they don’t appear to be aiding money-laundering actions.

The European Union is transferring towards a harmonized framework for AML in addition to combating terrorism financing (CFT), with the institution of the EU single rulebook/package. The latter, consisting of four legislative proposals, so as to streamline AML requirements across European member states, in addition to create a supra-national authority underneath the AMLA EU. In the close to future, compliance with AML regulations for “selected obliged entities” presenting a high danger might be monitored by the long run European establishment AMLA EU (Anti-Money Laundering Authority of the European Union). Thus, an enhanced give consideration to those establishments might have an important impression on their want for compliance to AML regulations. Sanction Scanner’s database consists of over up-to-date global 3000 Sanctions lists, Pep lists, and Adverse Media Data.

Financial institutions are held to high standards with regards to following procedures to determine money laundering. All bank employees are educated to some extent to identify and monitor suspicious customer activity. Larger monetary establishments may also have devoted departments to trace fraud and money laundering. While AI tools have improved money-laundering detection, they’re not perfect; these applications can nonetheless flag accounts and financial transactions in error.

While such establishments are legally obligated to follow anti-money laundering regulations as they relate to the country they operate in, not all agree with them. Implementing the insurance policies are sometimes costly and ineffective, and the net benefit of getting them in place often comes into question. The first anti-money laundering buildings took place with the Financial Action Task Force (FATF). It ensures that international standards are put in place to stop money laundering.

Due-diligence Checks

Anti-money laundering initiatives increased globally following the formation of the Financial Action Task Force (FATF) in 1989. It was established to develop international standards to tackle money laundering and promote implementation in different countries. The decentralized nature of cryptocurrency markets makes it difficult to implement and enforce AML regulations. The European Union (EU) and other jurisdictions had adopted comparable anti-money laundering measures to the us

Anti-money laundering (AML) in the cryptocurrency business refers to the measures taken to forestall cryptocurrencies from getting used to facilitate money laundering and different illicit activities. Regulatory bodies problem AML pointers outlining the types of exercise that should be monitored (e.g., making quite a few money deposits or withdrawals over a quantity of days to keep away from a reporting threshold). If an AML investigator discovers conduct that exceeds reporting standards and has no apparent enterprise objective, they need to submit a SAR/STR with the FIU to be able to meet regulatory obligations.

In addition, some countries have also launched laws that require cryptocurrency firms to adjust to AML legal guidelines and report suspicious exercise to the related authorities. Due to this increased threat of cash laundering, AML rules require banks to have a KYC process in place to be able to confirm their customers’ identities and make sure they aren’t collaborating in money laundering actions or monetary crimes. As such, once the banks have established their customers’ identities, they will carry out a customer due diligence check to be able https://www.xcritical.in/ to establish their stage of risk. The last step in the KYC course of is ongoing monitoring where the financial institution repeatedly checks to verify where massive sums of money originate or some other changes that should warrant investigation. Hence, financial institutions want to monitor their customers’ actions in order to have the power to determine and report suspicious deposits or transactions. On a national degree, Financial Investigative Units (FIUs) are on the forefront of AML.

Anti-Money Laundering (AML) is a set of insurance policies, procedures, and applied sciences that forestalls cash laundering. It is applied within authorities techniques and large monetary institutions to watch potentially fraudulent exercise. To combat cash laundering as properly as counter-terrorism financing (CTF), the European Parliament lately adopted the 5th Anti-Money Laundering Directive. Rather than a brand new legislation, this directive is an modification to the EU’s 4th Anti-Money Laundering Directive, which goals to bring higher transparency to the monetary system and forestall its use for the funding of felony actions.

Financial institutions have been required to report money deposits of more than $10,000, gather identifiable data of monetary account house owners, and maintain data of transactions. The KYC course of aims to stop cash laundering at the first step when customers try to retailer funds in financial accounts. It can be good apply to hold out AML checks when needed for present clients, for instance, when their circumstances change. FATF recommends the extent of buyer due diligence should be determined by a risk-based method. AML checks are a safeguard to help forestall businesses from turning into directly or not directly caught up in criminal activity.

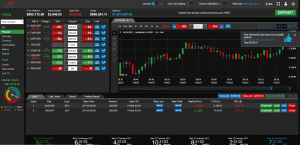

Transaction monitoring, transaction screening and client screening are all essential instruments within the toolkit for establishing the mandatory inner controls and monitoring techniques to are required to information and inform the extent and intensity of AML checks. AML techniques are important for making certain companies have the interior controls, processes and intelligence to establish and protect against the risk of money laundering. A due diligence examine is a process performed with the help of due-diligence software or risk and compliance verify tools for figuring out, evaluating and verifying all out there details about a person or entity. Conducting strong due diligence risk and compliance checks through a dependable supply means you presumably can trust in your small business dealings. Several domestic and worldwide authorities organizations, establishments and law enforcement struggle cash laundering around the globe. AML in monetary institutions must adhere to strict AML laws and AML rules, such because the USA PATRIOT Act and FATF guidelines.

Countries like Afghanistan has the very best cash laundering danger rating eight.16 adopted by Haiti (8.15), Myanmar (7.86), Laos (7.82), Mozambique (7.82), Cayman Islands (7.64), Sierra Leone (7.51), Senegal (7.30), Kenya (7.18), Yemen (7.12). In 1989, the Global Financial Action Task Force (FATF) was shaped by a bunch of governments and organizations. Its mission was to develop and promote worldwide standards for preventing cash laundering. After the 9/11 attacks, the FATF expanded its focus to include anti-money laundering (AML) and terrorism financing. Only lately, underneath the Anti-Money Laundering Act of 2020, did U.S. companies turn out to be legally required to adjust to financial screening regulations that apply to fiat currencies and tangible belongings.

Uk Fraud Awareness Report 2024

Anti-money laundering (AML) is a set of rules, rules, legislations, legal guidelines, regulations, processes, and tools particular to the monetary sector, whose objective is to sort out actions of laundering illicitly obtained funds by felony or terrorist organizations. Financial establishments and other companies in plenty of nations have a legal obligation to follow directives for doing this. For instance, monetary and insurance coverage establishments are obliged to examine their clients according to „Know Your Customer“ (KYC). An AML program is a set of procedures and policies designed by financial establishments to prevent, detect, and report cash laundering and terrorism financing actions.

- Anti-Money Laundering (AML) includes policies, laws, and laws to forestall criminals‘ monetary crimes and illegal activity.

- Transaction monitoring, transaction screening and consumer screening are all essential tools within the toolkit for establishing the required internal controls and monitoring systems to are required to information and inform the extent and intensity of AML checks.

- Customer due diligence is applied to screening and validating prospective clients under Know Your Client (KYC) requirements.

- On the opposite hand, KYC is the step that financial institutions and banks make the most of to confirm their customer identification.

- Financial establishments are the most distinguished customers of AML legislation, as they are compelled to report any suspicious habits to authorities.

Still, they’re additionally at a higher threat of cash laundering since they provide credit score to shoppers who open accounts with the company. Anti-money laundering (AML) refers to legally acknowledged guidelines for preventing money laundering. Customer due diligence (CDD) refers to practices monetary establishments implement to detect and report AML violations. Know your client (KYC) is the application of a element of CDD that involves screening and verifying prospective shoppers.

The Basel Committee on Banking Supervision’s CDD for Banks supplies detailed recommendations for banks on how to establish and verify the id of their clients. AML (Anti-Money Laundering) is a universally accepted phrase for combating and stopping money-related monetary crimes. The Anti-Money Laundering (AML) process consists of laws, legal guidelines, and policies for limiting and combating cash laundering activities and crimes. Customer due diligence (CDD) refers to the inspection financial institutions (and others) are expected to hold out to stop, identify, and report violations.

In Easy Phrases, What Is Aml?

As a end result, businesses that failed to develop a powerful AML program and did not reveal enough monitoring had been fined. The Office of Foreign Assets Control (OFAC) in the USA develops applications to safeguard U.S. foreign policy and national interests. Additional laws was handed in the 1980s amid increased efforts to struggle drug trafficking, in the 1990s to enhance monetary surveillance, and within the 2000s to cut off funding for terrorist organizations. Record preserving and report retention insurance policies which think about suspicious activities stories, consent request, personal information, third-party arrangements and training data. FINRA supplies an Anti-Money Laundering Template to assist Small Firms in establishing the AML compliance program required by the Bank Secrecy Act, its implementing rules, and FINRA Rule 3310. – Customer Due Diligence(CDD)Companies must identify and verify a customer’s identity, name, residential handle, and photographs.

As their adoption rate increases, financial establishments see reductions in error rates, permitting them to stay compliant with anti-money laundering legal guidelines and laws extra efficiently. While cash laundering is an international crime, many guidelines are native, and so they can typically conflict with federal insurance policies, making it difficult for financial institutions to remain compliant with rules and rules. Some banks even decided to suspend providers in international locations that make it onerous to stay compliant or have a status for facilitating money laundering.

Finra Utility Menu

It includes conducting danger assessments, implementing CDD measures, ongoing monitoring of transactions and staff training, and guaranteeing compliance with both nationwide and international regulations to combat financial crimes. Anti-money laundering (AML) legal guidelines are necessary in the banking sector because they help to prevent the unlawful funneling of cash via financial institutions. These legal guidelines forged a large web, requiring banks to track and report suspicious exercise, as previously mentioned.

What Is Aml (anti-money Laundering)? History Of Aml

By law, U.S. residents should report receipts of multiple related funds totaling greater than $10,000 to the Internal Revenue Service (IRS) on the IRS Form 8300. Gain limitless access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, professional AML Regulations Apply to Crypto Exchanges reviews and assist, the possibility to work with real-world finance and research tools, and extra. See additionally Money Laundering Regulations 2017 and Money Laundering Regulations 2019 for further data on the necessities of the regulations.

Sanction Scanner’s Aml Solutions

The United Kingdom stays the global money-laundering capital with an estimated £90 billion laundered every year by way of the City of London. – Transaction ScreeningScreening transactions of purchasers for any suspicious scenario or controlling consumer conduct ought to match with the transaction historical past. Banks have to keep related doc data about their customers to help legislation enforcement agencies. When we have a glance at the history of Anti-Money Laundering, the USA is certainly one of the first international locations that began to legislate the struggle towards Money Laundering in the Seventies. The Financial Action Task Force (FATF) was established in 1989, and FATF is a supranational group for fighting against cash laundering and monetary crimes worldwide. Also, the International Monetary Fund (IMF) is another organization combating money laundering crimes.

To study more about tips on how to improve your anti-money laundering compliance , join a free IBM Cloud Account right now. – Know Your Customer (KYC)Banks must identify their buyer, and in addition confirm the data supplied by customers. This process consists of buyer face verification, ID document verification, and handle verification.